NPMB PLC

Frequently Asked Questions & Answers

FREQUENTLY ASKED QUESTIONS AND ANSWERS ON NHF AND OTHER LOAN PRODUCTS

Mortgage Banking – National Housing Fund (NHF)

- Who can benefit from the scheme?

The NHF scheme is for Nigerians in all sectors of the economy, particularly those within the low and medium income levels who cannot afford commercial housing loans e.g. Nigeria Police officers and men etc. Any intending beneficiary must be registered contributor and up to date with his/her contributions.

- How can only 2.5% of my monthly basic salary or income be sufficient to obtain loan, to build a house?

The 2.5% of monthly basic salary contribution qualify you to access the loan. The pool of funds created by the contributors nationwide becomes available to any contributor to borrow from, after contributing for a minimum of six months.

- How does a contributor obtain NHF loan?

A contributor interested in obtaining NHF loan applies through Nigeria Police Mortgage Bank Plc, a registered and duly accredited mortgage loan originator, who packages and forwards the application to FMBN.

- Is it the monthly contribution that determines the loans amount?

No. the loan amount is determined by the applicant’s affordability. This entails his/her income level that will enable repayment of the loan.

- What are the documents required when applying for the loan?

Documents required to process a loan include:

- Completed application form.

- Photocopy of title documents

- Current valuation report on the proposed house to buy or bills of quantities (BOQ) for the house to build.

- Three years tax clearance certificate.

- Evidence of NHF participation

- Copy of pay slips for the previous three months.

- Equity contribution or personal stake of 20%, 10% and 0% depending on the loan amount applied for.

- What is the mode of repayment?

NHF housing loan are repaid on monthly installation from the monthly income of the beneficiary. This mode of repayment has the advantage of been both affordable and convenient.

- Can a contributor obtain NHF loan, if a mortgage loan originator is not in his/her state?

Yes. A prospective applicant can liaise with Nigeria Police Mortgage Bank officers (mortgage loan originator) in a neighbouring state or anywhere in Nigeria to process a loan application.

- Are there restrictions as to where a contributor can build his/her house?

The property can be located anywhere as long as it is within Nigeria. The applicant must however provide acceptable title documents to the land.

- How can a low income earner get collateral for a loan?

The only collateral is the property in question. No any other collateral is needed to secure the NHF loan.

- How many times can I get NHF loan?

A contributor can only obtain NHF loan facility once in a life time.

- What is the maximum loans amount and repayment time for NHF loans?

A contributor is eligible to access a maximum loan amount of N15million repayable over a maximum period of 30 years at an affordable interest rate of 6%.

- Can I obtain NHF loan to purchase a piece of land to build a house?

No. a prospective applicant who wishes to obtain a loan to build a house is expected to have his/her land as well as an acceptance title to the land prior to the application for NHF loan.

- Can I get loan as an individual to build a house or must I buy a government owned estate or a private estate developer?

Yes. You can apply as an individual for NHF loan to develop a land or buy directly from government consort estate or private estate developer.

- Is NPMB a registered Mortgage Bank with the Federal Mortgage Bank?

Yes, it was incorporated in 1992 as a limited liability company.

- Is NPMB one of the Mortgage Banks licensed to participate in the National Housing Fund (NHF) operated by Federal Mortgage Bank of Nigeria (FMBN)?

As stated above, NPMB is a registered mortgage institution with FMBN and is licensed to participate in all mortgage schemes operated by FMBN, including the NHF.

- How long has NPMB been into providing Mortgage services?

NPMB has been providing mortgage services since 1992.

- What interest rates does NPMB charge for its Mortgage facilities?

For mortgages under the NHF, NPMB charges an annual interest rate of 6% for periods of up to 30 years (depending on age and income) For Commercial mortgages, interest rates are dependent on prevailing market rate. However tenors under this category typically range between 1 year to 5 years.

- Is there a specific tenure for the mortgage facilities offered by NPMB?

As discussed above, the tenure of mortgages depends on the mortgage scheme, and as determined by the Federal Mortgage Bank of Nigeria (FMBN).

- Must I have an account with NPMB before I benefit from your Mortgage services?

To enjoy NPMBs mortgage services, you are required to have an account with NPMB to accommodate the mortgage.

- Must I operate my account for six months in NPMB before I get a loan?

To get a loan from NPMB, you are required to have an operational account. However, you can still benefit from NPMBs mortgage services even if you have not operated your account for up to six months.

- Can retired employees also benefit from your mortgage services?

Retirees can also participate in all our mortgages services except the NHF Loans. As a client-focused institution, NPMB caters for all class of customers including low income earners. However, this will depend on the value of their request.

- Is the NHF Loan for only contributors to the scheme?

Yes. The NHF loan is for contributors who have made subscription to the Fund for a period of at least six months. For new subscribers that wish to benefit from the scheme, they can make the six month payment at once and continue subsequent monthly payments.

- At what interest rate does a Contributor access the NHF Loan through NPMB?

Eligible contributors can access the NHF loan at an interest rate of 6% per annum.

- Can the NHF loan have tenors that are more than 10 years?

Yes. Subject to age and income of the contributor, the NHF loan can be accessed for a maximum period of 30 years.

- What makes a contributor eligible to access the NHF Loan?

A contributor becomes eligible to access the NHF loan after making contributions for a minimum period of six months.

- Is there an age limit after which a customer becomes ineligible to benefit from the NHF Loan?

Yes. The age limit is 60 years, which corresponds with the retirement age in the civil service.

- Can the NHF Loan be used to construct a new house?

Yes, but you must have initially developed the house up to 30% completion stage.

- Can it be used for renovating an existing house?

Yes, you can apply for the purpose of renovation, as long as you have a certified Bill of Quantities (BOQ).

- Is there a maximum amount that can be accessed by Contributors?

Under the NHF scheme, the maximum amount that can be accessed is N15m

- How long does it take for applications to be processed by FMBN?

It takes between 6 – 18months for NHF Loans to be processed and disbursed.

- Does a contributor apply for the NHF Loan before or after identifying a house?

After identifying and being offered the house by the owner.

MORTGAGE BANKING – COMMERCIAL MORTGAGE FACILITY

- Does NPMB provide other mortgage facilities that are not under the NHF schemes?

Yes, NPMB provides mortgage loans that are not under the NHF to its customers.

- At what rate does NPMB provide the Commercial Mortgage Facility?

CMF is offered to customers at the prevailing market rates.

- Is the Commercial Mortgage Facility for only houses?

It can be used for shops, land and other real estate properties.

- Can the Commercial Mortgage Facility be for tenors of up to 10 years?

No, the maximum tenor under the CMF is 5 years

- Can I use the CMF to build a new house?

Yes, you have to have developed the property to 30% completion stage.

- Can the CMF be used to renovate an existing house?

Yes it can provided that there is a Bill Of Quantities (BOQ) for the renovation work to be carried out.

- Can a CMF be converted to an NHF Loan? (if yes, what is the procedure?)

Yes, CMF could be granted to enable the customer make payment for a property pending release of NHF loan. When the NHF loan is granted, the CMF could then be converted to the NHF loan. However all outstanding payments under the CMF must be paid notwithstanding the NHF loan

- Can I use my shares to secure the CMF?

Yes, normally, we will use the property being financed; shares come in as additional comfort.

- What other Collaterals can be used to secure the CMF?

Ideally, the property being financed or alternative real property. Other forms of securities, such as shares of quoted companies, may be accepted.

- Is the CMF open to Civil servants?

Yes, depends on the ability of the civil servant to pay back the loan.

- Must I have an account with NPMB to benefit from the CMF?

Yes you would have to open a current account with NPMB

LOANS

- I have just received my Offer Letter from FCDA, can I get a loan?

Yes, but only if you meet the requirements. Please see any of our Customer Service Officers or your account officer for more details.

- FCDA has changed the value of my property upwards. Can I get an additional loan?

Yes. But you will be required to pay 10% equity and 2% administrative fees. You will also be required to complete new application forms.

- I want to start a business. Can NPMB assist me with a mortgage?

No. Mortgages are for Real Estate/Property only.

- I am unable to come to your Head Office as I live out of town. Do you have direct phone lines?

Yes. If you have any enquiries regarding mortgages please contact our Customer Service Officers on the following numbers: +234-8183396944, 08039420996, 09057333776, 08032813799, 08023065835,

- I would like to rent/let/lease my property, can I do this?

No, you are not allowed to rent/let/lease your property without prior consent of the bank. If you intend to rent/let/lease your property, you should write to us indicating your intentions stating the rental period and amount. Should the information prove satisfactory, our Legal Team will give consent in writing to the rent/let/lease of the property?

- If I like to pay off/reduce my mortgage loan, can I do this?

Yes. This is referred to as ‘Balloon Payment or Part Liquidation’ or ‘Termination’. To do this, you should first deposit the amount you wish to pay into your loan current account. Then write the Bank for in this regards. Once the “Balloon Payment’’ is done, you can collect your new repayment plan from your branch within 48hours of submitting your request. Alternatively contact your Account Officer to process this on your behalf.

- What types of mortgages are available NPMB?

National Housing Fund and Commercial Mortgage Loans

- Can I know my Mortgage Account Balance?

Yes. See one of our Customer Service Officers or your account officer.

- May I get a loan to renovate my house?

Yes. Please contact our staff in the Products & Market Division. As long as your salary is domiciled with the Bank.

- Can I get a mortgage before I find my property?

You cannot get a mortgage loan without having a property that you can use as security for the loan.

- How do I pay back my mortgage?

The most common type of payment is the monthly repayment. Offering the greatest simplicity, your monthly repayments cover both the principal and the interest on the loan (deducted from your account monthly), so that at the end of the term/tenor you have completed all payments.

- I am a Career Public Servant. Can I get a mortgage?

Yes you can. All career public servants can make an application for a mortgage as long as they are in full time employment at the date of application.

- What other costs will I incur in taking out a Mortgage?

When you take out a mortgage, you should be aware that in addition, you will have to pay valuation and processing fees. Once you take ownership of the property, NPMB will insist you take out insurance cover on the building. It is advisable to take out contents insurance as well. Always look at the total package and not just focus on the costs or interest rates.

- What is the early repayment charge for my mortgage?

Not applicable for now

- Why is my interest payment higher than my principal payment?

Your monthly repayment depends on the tenor of your loan and is calculated at a reducing annuity mortgage basis. The principal has to be spread over the period or duration of the loan. For example, if you a have N5millon loan for a tenor of 5years, the principal repayment has to be spread through 5 years. Therefore as you pay your principal (which makes up part of your monthly repayment) which has been spread, you reduce the interest paid on the loan. While your monthly repayment remains as stated in your offer letter, the components of this repayment (interest and principal) may be seen on your statement to vary. Your interest repayment on the onset is higher than the principal repayment, but tapers off (reduces) over time as you service your loan, while your principal repayment which starts off as lower than the interest repayment increases until it exceeds the interest portion of the repayment while the loan is being serviced.

- Why do I need to pay insurance premium quarterly?

Insurance (Mortgage Protection Assurance) and (Fire & Special Peril) premium is paid on annual basis to protect you from the risk associated with such unforeseen circumstances/natural disaster like fire, collapse, storm and death. The insurance also helps protect your mortgage repayment in the event of you being temporarily incapacitated

- How do I make an insurance claim?

In event of any unforeseen circumstance affecting you or your property (for which you got the mortgage) which could include damage to the property due to fire, rain storm, wind, earthquake etc; you can make an insurance claim in this instance by providing the following documents

– Application letter to support the claim

– Pictures of the damage to the property

– Offer Letter

– Copy of the receipt for payment of the property

– Bill of quantities for the repair of the damage

– Duly completed Insurance Claim Form (available from your branch CSO)

Any of our Customer Service Officers will be happy to answer any other questions you have regarding making an insurance claim.

INSURANCE PREMIUM ON MORTGAGES

- What is Insurance?

This is a system or process by which one party referred to as the insurer agrees to indemnify the other party called the insured in the event of any financial or material loss after due payment of a consideration called premium.

- What is a premium?

A premium is the payment you make on the insurance policy payable annually. Premiums are calculated based on the property value, loan balance and age of the person who is insured by the policy and tenor of loan. The younger you are, the lower the premium.

- Why do I need insurance?

One of the most important reasons to purchase insurance is to ensure your loved ones are provided for financially. Mortgage Protection is useful in helping your survivors pay your mortgage debt after your death. o General Protection is useful in helping to reinstate or replace property damaged or destroyed.

- What is Mortgage Protection?

Mortgage protection is a contract between the policy owner/insured and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured’s death. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals.

- What is General Protection?

This provides indemnity to the insured in the event of loss or damage to property covered under it as a direct result of fire outbreak, lightning or explosion. It is a contract wherein the insurer guarantees to pay for the loss and damage to the property for the specified period of time (normally the policy is a one year policy and renewable annually).

- What factors generally drive insurance calculations?

Premium rates for mortgage protection are typically based on factors such as:

- Age, Loan Balance, Loan tenor

- Premium rates for general protection are typically

- Negotiable and determined by the insurance companies after its risk analysis.

- How soon does the coverage start and how long does it cover for?

Generally the coverage starts once premium is received by the insurance companies. The cover is usually for a year and premium is remitted annually.

- Will I get my certificate?

A master policy will be provided by the insurance company. Individual certificates containing abridged policy information will also be provided, which will be electronically mailed to customers.

- What happens when the premium expires and no premium is paid?

Annual premium is to be paid, in the event no premium is paid to the insurance companies; there is no cover for any event that happens within that period no premium was paid.

CBN’S KYC Requirement for DNFBPs

- What is DNFBPs?

DNFBP is an acronym for “Designated Non-Financial Businesses and Professions”.

- What is SCUML?

SCUML means Special Control Unit against Money Laundering and is charged with the responsibility of monitoring, supervising and regulating the activities of Designated Non-Financial Institutions (DNFIs).

- Which Businesses and Professions (DNFBPs) Are Currently Being Regulated By SCUML?

CBN/EFCC has classed the following categories of businesses and professions as DNFBPs:

- Dealers in Jewellery,

- Dealers in Luxury Goods,

- Chartered/Professional Accountants,

- Audit Firms,

- Tax Consultants,

- Clearing and Settlement Companies,

- Legal Practitioners,

- Trust and Company Service Providers,

- Estate Surveyors and Valuers,

- Hotels and Hospitality Industry Businesses,

- Dealers and Miners of Precious Stones and Metals,

- Pool Betting, Casino and Lottery,

- Supermarkets,

- Non-Governmental Organizations,

- Consultants and Consulting Companies,

- Construction Companies,

- Estate Agents, Dealers in Real Estate,

- Importers and Dealers in Cars and Vehicles,

- Dealers in mechanized farming equipment and machinery,

- Practitioners of mechanized farming and any other business(es) as may be designated from time to time by the Federal Ministry of Trade and Investment or SCUML

- Where can I obtain the registration form?

Registration forms are available in the branches for onward submission at SCUML offices o http://www.scuml.org.

- What categories of customers are expected to comply with this Directive?

Both New & Existing Customers

- What are the requirements for SCUML registration?

- Certificate of Incorporation.

- Article and Memorandum of Association.

- Tax Clearance Certificate (Not Applicable to NGOs).

- Audited Financial Report.

- Authorised Operational License (Not Applicable to NGOs).

- Company/ Organization Profile.

- Constitution (For NGOs Only).

- Agreement Signed between the NGO and the National Planning Commission (For International NGOs Only)

- Where are the SCUML offices located?

- Head Office: No. 1 Obosi Street off Ladoke Akintola Boulevard beside PHCN Garki II office Abuja. Tel: (234) 09 7806364 Website: http://www.scuml.org E-mail: info@scuml.org

- Lagos Zonal office: 15, Awolowo Road, Ikoyi, Lagos State

- Kano Zonal office: GP 360 Bida Road, Civic Centre, Kano State

- Port Harcourt zonal office: 8, Bank Road, (off Moscow Road), Port Harcourt, Rivers State.

- Enugu Zonal office: Plot 106 Federal Government college road, Independence Layout, Enugu.

- Gombe Zonal office: No.4, EFCC Street, New G.R.A Gombe, Gombe State.

- Where can I make enquiries on the CBN KYC requirement?

For more information, contact SCUML Registration Office on (234) 09 7806364 or visit their website on http://www.scuml.org or visit our branches

DUD CHEQUES

- What is a dud cheque?

A dud cheque is a cheque that is written for more than what is in the bank e.g. a cheque for N200 when the person only has N150 in the bank will bounce (be dishonoured) – the cheque is a dud

- What action does the Central Bank of Nigeria (CBN) require my bankers to take should I inadvertently issue a dud cheque?

Your bankers are required to send names of its customers who have issued up to three (3) dud cheques to the CBN. So if you issue dud cheques up to three times, NPMB Plc will be constrained to send your name to the CBN.

- Is it true that I need to make a pledge not to ever issue dud cheques?

Yes, you do. The CBN requires that you give your bankers a written pledge that you will never issue a dud cheque. NPMB PLC has made this easier by creating pledge forms you can use for this purpose. Please see your Relationship Manager or branch Customer Service Officer for a copy of this form for your use.

- How do I give my bank my pledge not to issue dud cheques?

Please avail yourself of the Dud Cheque Pledge Form.

- Are there any penalties if I inadvertently issue dud cheques?

Yes there are. NPMB will be constrained to send your name to the CBN who could then forward same to EFCC for further action.

Why is the CBN doing this?

The CBN’s action is geared to support its Cash Less policy and improve customer confidence in the use of cheques as a medium of payment.

Housing Needs

Housing Design

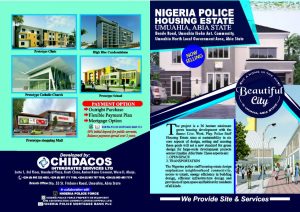

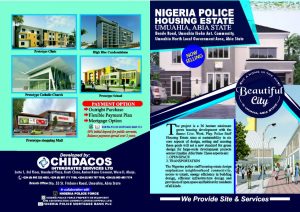

Nigeria Police Housing Estate, Umuahia

Nigeria Police Housing Estate, Umuahia, Abia State is now selling.

For more enquiries and info please call, Continue Reading